404 - Page Not Found

The page you requested does not exist. Maybe try a search?

KG Shambhala Centrally located in the strategic residential destination of Shanthi Colony, in Annanagar, KG SHAMBHALA enjoys close proximity to VR Mall, Koyambedu, & Thirumangalam Metro. With enviable connectivity to all major city hubs via road & metro, this spectacular abode is surrounded by an extensive selection of prestigious educational institutions, renowned healthcare establishments, popular restaurants, entertainment hubs and shopping malls.

Overall in charge of marketing strategy and business growth in sales, through marketing efforts. Must have sound knowledge for digital marketing and significant experience in a real estate builders office in innovative pre-launches, launch and post launch sales of flats and offices.

Overall in charge of marketing strategy and business growth in sales, through marketing efforts. Must have sound knowledge for digital marketing and significant experience in a real estate builders office in innovative pre-launches, launch and post launch sales of flats and offices.

KG Builders' customer-centric programs place customer-satisfaction first and our Happiness Meter is a testimony of our commitment to that. A measurable metric that tracks and monitors the degree of happiness of our customers on different home buying parameters rated by fellow customers. Our Happiness Meter tool aims to help new customers in their home buying process and create an enjoyable home buying experience.

Exclusive living spaces for the privileged few in the bustling heart of Kodambakkam. Located at the heart of Chennai, between 100’ Road and Anna Salai, Kodambakkam is getting ready to witness a new housing star, With the comfort and convenience of what the people look for in a locality & the premium lifestyle that KG Offers!

The location of KG Earth Homes was carefully planned to ensure that residents would need minimal travel time to access prime work areas, schools, colleges and shopping. Less travel time would result in less fuel consumption and more free time to spend on family.

The location of KG Earth Homes was carefully planned to ensure that residents would need minimal travel time to access prime work areas, schools, colleges and shopping. Less travel time would result in less fuel consumption and more free time to spend on family.

Located in the perfect spot between the city and lush greenery, between the older parts of Chennai in the north and the new developments in the south, it offers easy access to the industrial area of Sriperumbudur, the IT hub on OMR as well as the purely residential areas of Porur, Poonamallee and Valasaravakkam. Surrounded by premium schools, colleges, shopping and medical facilities, the entire project still manages to remain tucked away from it all in a spacious, verdant layout near the Chembarambakkam lake.

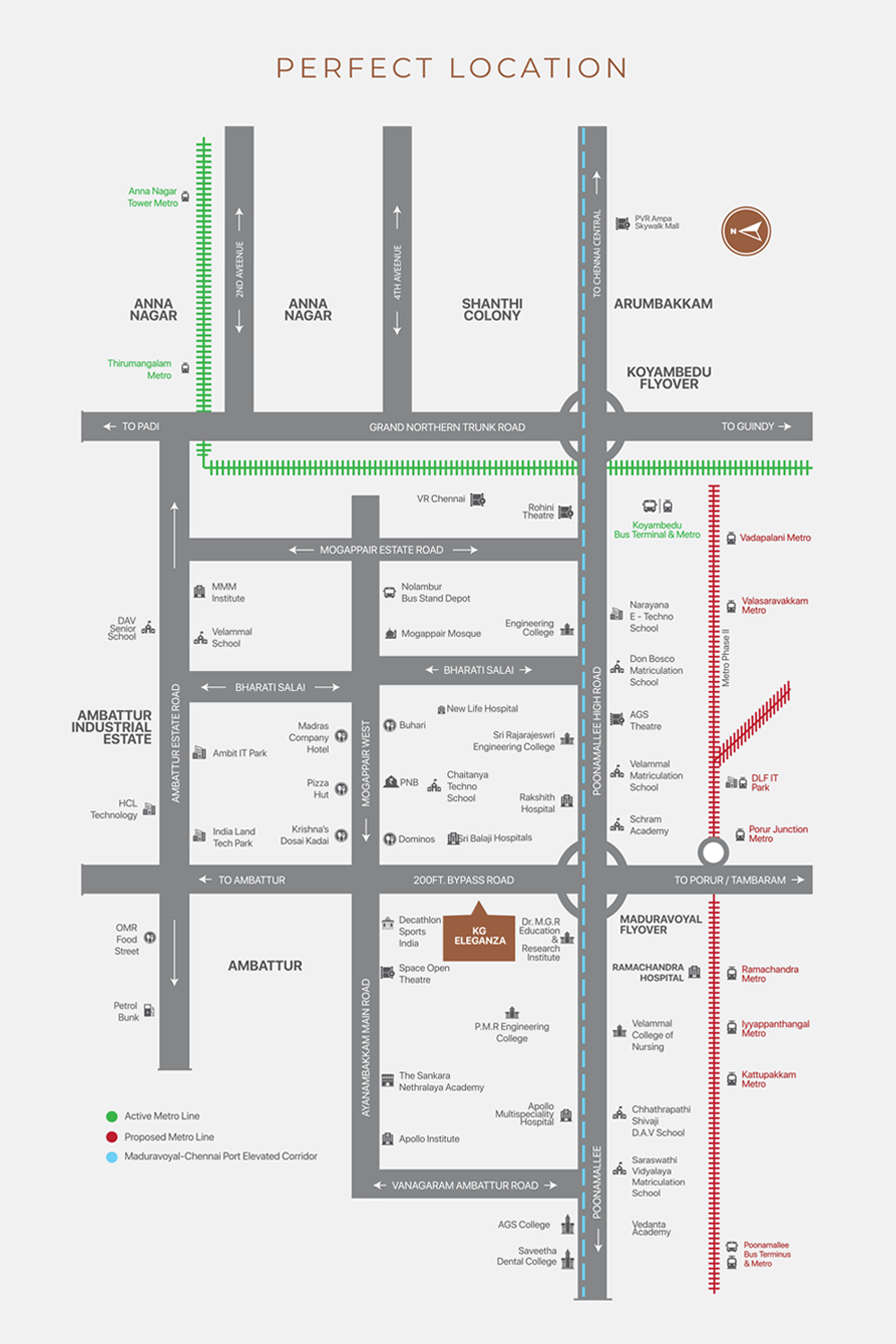

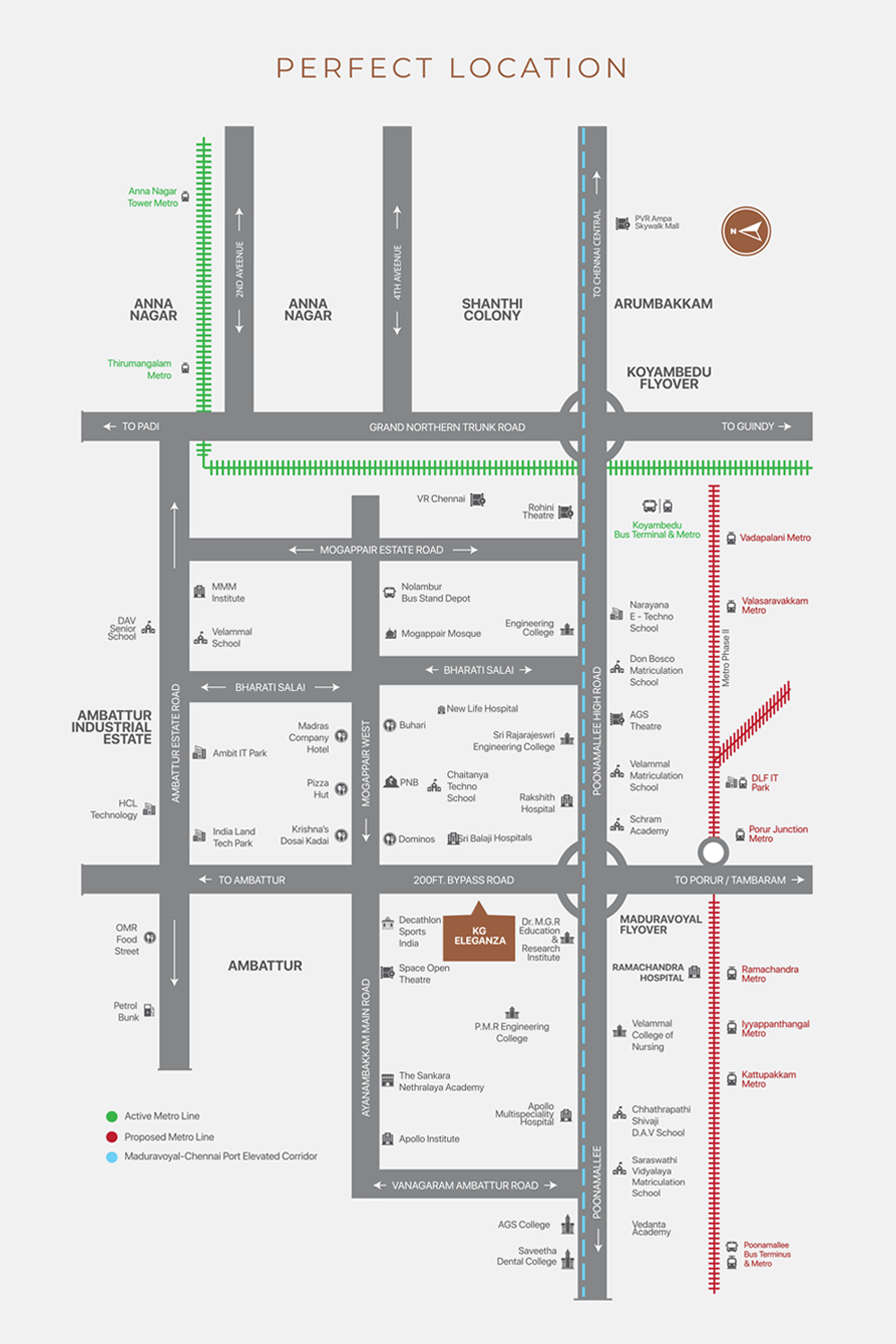

Located at Mogappair, near Anna Nagar, KG Signature City 2.0 is KG's latest offering to Chennai's skyline. It is strategically situated on the wide new 200 feet bypass road connecting Maduravoyal to Red Hills through Ambattur and Poonamallee. Its proximity to Anna Nagar, Ambattur, Maduravoyal, Mogappair, Poonamallee and Koyambedu make it an ideal place to reside! KG Signature City 2.0 is just a few meters away from Poonamallee High Road and less than 5 kms from the buzzing activity of Anna Nagar. The abundance of highly ranked schools, colleges, specialized hospitals and the recent influx of IT offices in the Ambattur Industrial Estate (AIE) have all catapulted it into a strategic location for business activities and makes it a highly desirable residential neighbourhood. Surrounded by IT companies, educational institutions and well developed social and public infrastructure, KG's latest offering in this high profile location conveniently serves the needs of its signature clientele.

KG Signature City is strategically situated on the new high profile 200 Feet ByPass Road in Mogappair connecting Maduravoyal in the south and Red Hills in the north through Poonamallee and Ambattur. It is just a few meters away from Poonamallee High Road and less than 5 Kms from the buzzing activity of Anna Nagar. Surrounded by IT companies, educational institutions and well developed social and public infrastructure, KG’s latest offering in this high profile location conveniently serves the needs of its signature clientele. The abundance of highly ranked schools, colleges, specialized hospitals and the recent influx of IT offices in the Ambattur Industrial Estate (AIE) have all catapulted it into a strategic location for business activities and makes it a highly desirable residential neighbourhood.

Located in the perfect spot between the city and lush greenery, between the older parts of Chennai in the north and the new developments in the south, it offers easy access to the industrial area of Sriperumbudur, the IT hub on OMR as well as the purely residential areas of Porur, Poonamallee and Valasaravakkam. Surrounded by premium schools, colleges, shopping and medical facilities, the entire project still manages to remain tucked away from it all in a spacious, verdant layout near the Chembarambakkam lake.